AI Automation in Accounting Firms: How Generative AI Is Transforming Accounting in 2025

Accounting firms today are under constant pressure. Growing volumes of data, tighter compliance timelines, fixed-fee engagements, and rising client expectations are pushing teams to their limits. While traditional automation and accounting software helped streamline some processes, they’ve reached a ceiling.

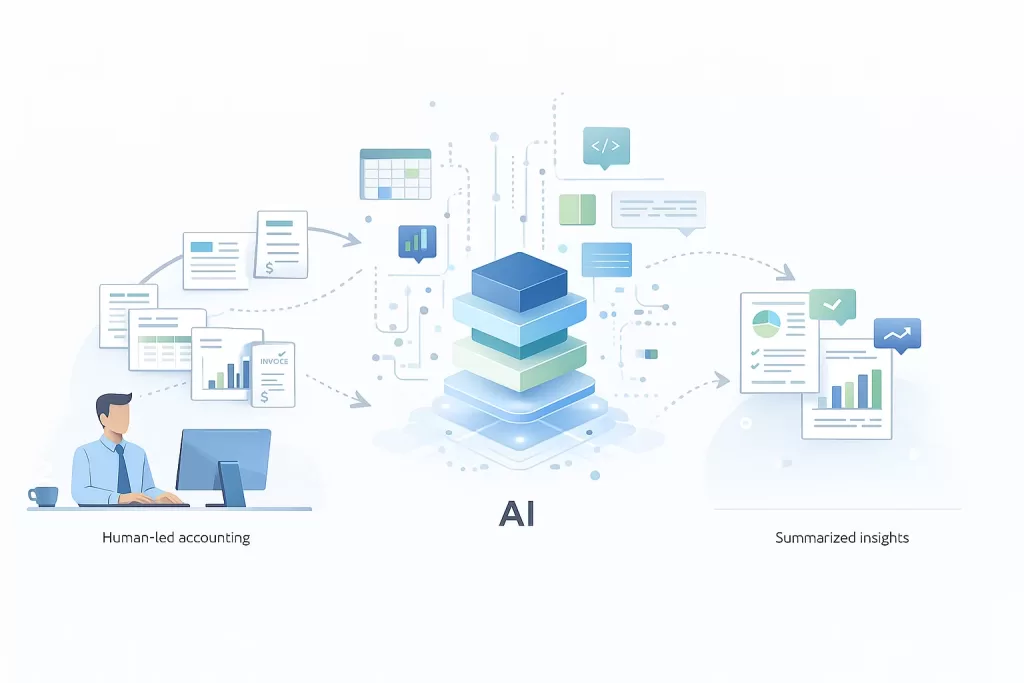

This is where AI automation in accounting firms is evolving beyond rule-based systems. With Generative AI for accounting, firms can reduce manual workload, improve accuracy, and scale operations—without burning out professionals or compromising compliance.

Importantly, this shift is not about replacing accountants. It’s about enabling them. Generative AI acts as a virtual accounting assistant, supporting professionals with speed, consistency, and insight—while judgment and accountability remain human.

The real question is no longer whether accounting firms should adopt AI, but how they can do so responsibly and effectively.

What Is Generative AI (Explained Simply)

Generative AI refers to AI systems that can understand, summarize, draft, and explain information using natural language. Unlike traditional automation, which follows predefined rules, Generative AI understands context and produces human-like outputs.

Think of Generative AI as an intelligent junior accountant who never gets tired—but always needs supervision.

It can:

- Read and interpret invoices, contracts, and audit files

- Draft reports, emails, and compliance responses

- Explain financial data in plain language

- Assist teams in navigating regulations and documentation

Generative AI works alongside existing accounting systems—it doesn’t replace them. Professional judgment, ethical responsibility, and regulatory accountability remain firmly with qualified accountants.

Key Use Cases for Accounting Businesses

Document Processing & Review

Accounting firms manage large volumes of documents every day. Generative AI can read invoices, contracts, and audit documents, extract key information, and flag missing or unusual entries. Long documents can be summarized into clear insights, reducing review time and manual effort.

Reconciliation & Exception Handling

Reconciliations are repetitive and error-prone. Generative AI can quickly identify mismatches across ledgers and bank statements and explain discrepancies in simple language—helping teams resolve issues faster and with greater confidence.

Compliance & Regulatory Support

Generative AI assists firms by summarizing regulatory updates, drafting standard responses for notices, and preparing compliance checklists. While final validation remains human-led, AI significantly reduces the effort required to stay current and prepared.

Financial Reporting & Analysis

Generative AI helps transform raw financial data into meaningful narratives. It can draft management reports, variance explanations, and client-ready summaries—freeing accountants to focus on interpretation and advisory.

In one such engagement, Electromech Cloudtech implemented a Generative AI–based report generation solution using NLP to automate narrative-driven reports, significantly reducing manual effort while improving consistency and turnaround time.

(Internal backlink anchored on “Generative AI–based report generation solution”)

Client Communication

Generative AI improves client communication by drafting emails, explaining audit findings, and responding to common queries. This ensures faster turnaround times and consistent communication quality without increasing staff workload.

Real Benefits for Accounting Firms

Firms adopting Generative AI experience measurable business outcomes:

- ⏱ 30–50% reduction in manual effort

- 📉 Fewer human errors in reconciliation and reporting

- 📊 Faster month-end and year-end closures

- 💼 Ability to scale client servicing without increasing headcount

- 🧠 More time for advisory and value-added services

Rather than replacing professionals, AI elevates their role—shifting focus from execution to insight.

Common Concerns & Myths

Will AI Replace Chartered Accountants?

No. AI handles tasks, not judgment. Ethical responsibility, interpretation, and accountability cannot be automated. Generative AI supports accountants—it does not replace them.

Is Financial Data Safe with AI?

When implemented on secure cloud infrastructure with access controls and private models, Generative AI can be deployed safely. The risk lies not in AI itself, but in unmanaged or public usage.

Is AI Too Complex to Implement?

Not when adoption is phased. Firms can start small, pilot internally, and expand gradually—without disrupting existing operations.

What Are the Challenges of Adopting AI in Accounting?

While the benefits are significant, adoption comes with real challenges that firms must plan for:

- Data readiness: Inconsistent or unstructured data can limit AI effectiveness

- Change management: Teams may resist new workflows without proper training

- Governance and controls: Clear policies are required to define where and how AI is used

- Over-reliance risk: AI outputs must always be reviewed by professionals

Successful adoption balances automation with accountability—treating AI as an assistant, not an authority.

What Tools Are Available for AI in Accounting?

AI in accounting is not a single tool—it’s an ecosystem that integrates with existing systems. Common categories include:

- AI-powered document processing tools for invoices and contracts

- Generative AI platforms integrated with cloud environments

- AI-assisted reporting and analytics tools

- Secure AI copilots embedded within finance workflows

The key is choosing tools that align with regulatory requirements and operate within a secure cloud framework.

What Is the Future of AI in Accounting?

Looking beyond 2025, AI in accounting will move from automation to augmentation. Firms will increasingly use Generative AI to:

- Support real-time financial insights

- Enable proactive compliance monitoring

- Strengthen advisory and consulting services

- Deliver faster, more personalized client experiences

Accounting firms that adopt AI responsibly will gain a competitive advantage—not by replacing people, but by amplifying expertise.

Building a Secure Cloud Foundation for Generative AI

Adopting Generative AI requires more than tools—it demands a secure, well-governed cloud foundation.

At Electromech Cloudtech, we help accounting firms enable responsible AI adoption by combining cloud expertise, security-first architecture, and practical implementation. Our focus is on helping firms move from experimentation to real-world value—without compromising compliance or control.For accounting businesses exploring Generative AI for accounting, the opportunity lies in combining human expertise with intelligent automation—built on a secure and scalable cloud foundation.